J. P. Morgan

American financier, banker, philanthropist and art collector

Years: 1837 - 1913

John Pierpont Morgan (April 17, 1837 – March 31, 1913) is an American financier, banker, philanthropist and art collector who dominates corporate finance and industrial consolidation during his time.

In 1892, Morgan arranges the merger of Edison General Electric and Thomson-Houston Electric Company to form General Electric.

After financing the creation of the Federal Steel Company, he merges in 1901 with the Carnegie Steel Company and several other steel and iron businesses, including Consolidated Steel and Wire Company owned by William Edenborn, to form the United States Steel Corporation.

At the height of Morgan's career during the early 1900s, he and his partners have financial investments in many large corporations and are accused by critics of controlling the nation's high finance.

He directs the banking coalition that stops the Panic of 1907.

He is the leading financier of the Progressive Era, and his dedication to efficiency and modernization helps transform American business.

Morgan redefines conservatism in terms of financial prowess coupled with strong commitments to religion and high culture.

Morgan dies in Rome, Italy, in his sleep in 1913 at the age of 75, leaving his fortune and business to his son, John Pierpont "Jack" Morgan, Jr., and bequeathing his mansion and large book collections to The Morgan Library & Museum in New York.

Related Events

Filter results

Showing 10 events out of 25 total

J. P. Morgan partners with the Drexels of Philadelphia to form the New York firm of Drexel, Morgan & Company in 1871.

Anthony J. Drexel becomes Pierpont's mentor at the request of Junius Morgan.

John Pierpont Morgan was born and raised in Hartford, Connecticut, to Junius Spencer Morgan (1813–1890) and Juliet Pierpont (1816–1884) of Boston, Massachusetts.

Pierpont, as he preferred to be known, had had a varied education due in part to interference by his father.

Pierpont had transferred to the Hartford Public School in the fall of 1848, then to the Episcopal Academy in Cheshire, Connecticut, (now called Cheshire Academy), boarding with the principal.

In September 1851, Morgan passed the entrance exam for the English High School of Boston, a school specializing in mathematics to prepare young men for careers in commerce.

Illness that is to become more common as his life progresses struck in the spring of 1852; rheumatic fever left him in so much pain that he could not walk.

Junius had sent Pierpont to the Azores in order for him to recover.

After convalescing for almost a year, Pierpont had returned to the English High School in Boston to resume his studies.

After graduating, his father had sent him to Bellerive, a school near the Swiss village of Vevey.

When Morgan had attained fluency in French, his father sent him to the University of Göttingen in order to improve his German.

Attaining a passable level of German within six months and also a degree in art history, Morgan had traveled back to London via Wiesbaden, with his education complete.

Morgan had gone into banking in 1857 at his father's London branch, moving to New York City in 1858 where he worked at the banking house of Duncan, Sherman & Company, the American representatives of George Peabody & Company.

From 1860 to 1864, as J. Pierpont Morgan & Company, he had acted as agent in New York for his father's firm.

By 1864, he was a member of the firm of Dabney, Morgan, and Company.

Thomas Edison switches on his Pearl Street generating station's electrical power distribution system, which provides 110 volts direct current (DC) to fifty-nine customers in one square mile of lower Manhattan, on September 4, 1882,

This is considered by many as the day that began the electrical age; the station is the first of many.

Earlier in the year, in January 1882, Edison had switched on the first steam-generating power station at Holborn Viaduct in London.

The DC supply system provides electricity supplies to street lamps and several private dwellings within a short distance of the station.

Edison had formed the Edison Electric Light Company in New York City in 1878 with several financiers, including J. P. Morgan and the members of the Vanderbilt family.

After making the first public demonstration of his incandescent light bulb on December 31, 1879, in Menlo Park, Edison had patented a system for electricity distribution in 1880, which is essential to capitalize on the invention of the electric lamp.

Edison had founded the Edison Illuminating Company on December 17, 1880

The company establishes the first investor-owned electric utility in New York City.

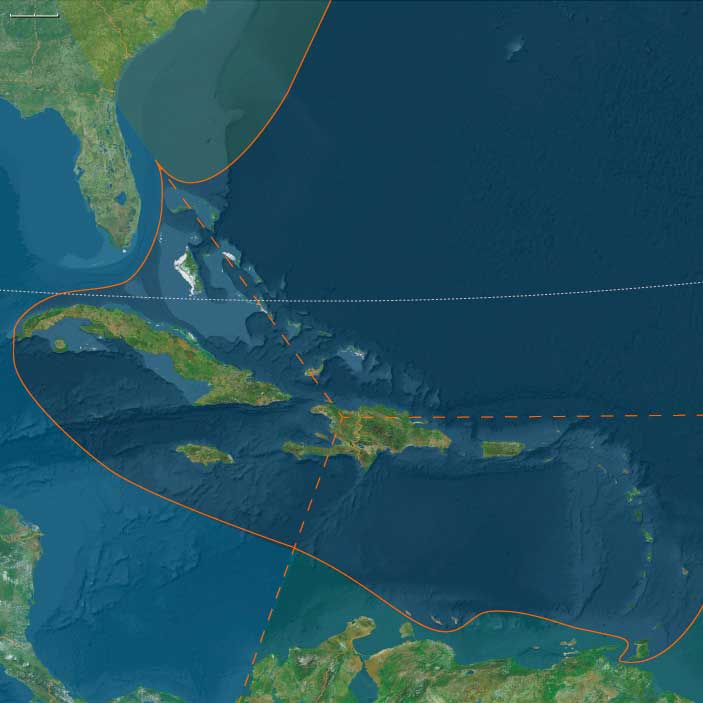

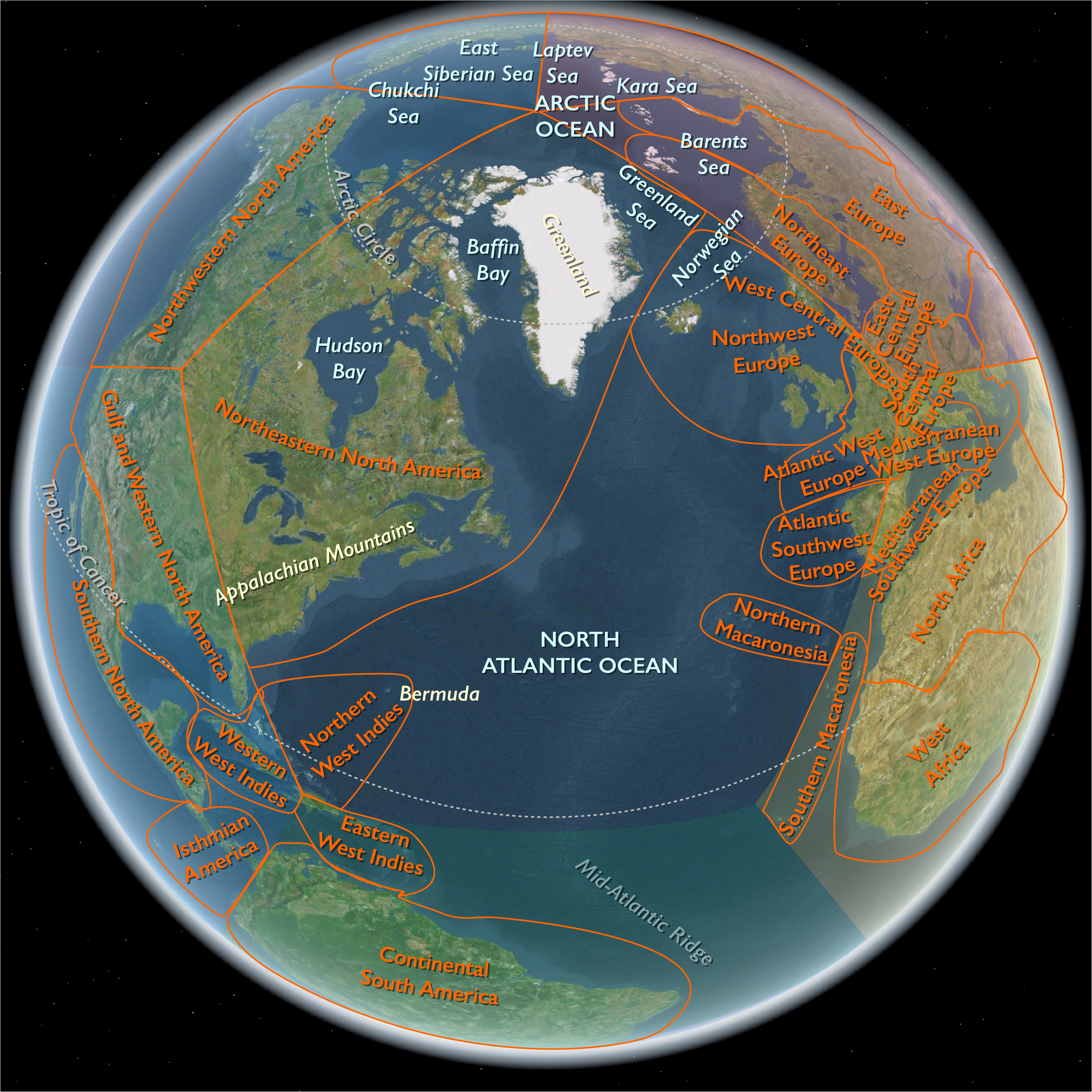

Northeastern North America

(1888 to 1899 CE): Industrial Titans, Immigration, Public Health, and Cultural Evolution

Between 1888 and 1899, Northeastern North America witnessed extraordinary industrial expansion, intensified immigration, health crises, cultural shifts, and significant political evolution. These years shaped the region through economic consolidation, urbanization, and profound social changes.

Rise of Industrial Titans

Rapid economic growth gave rise to powerful industrialists, including Cornelius Vanderbilt in railroads, John D. Rockefeller in petroleum, and Andrew Carnegie in steel. Banking emerged as a key economic driver, notably under the guidance of financier J. P. Morgan. Technological innovations by Thomas Edison and Nikola Tesla transformed urban life, distributing electricity broadly for industry, home use, and street lighting.

Trusts and Monopolies

Corporations such as Standard Oil dominated their industries. The formation of monopolistic trusts extended beyond oil to sugar, whiskey, and lead. After the Sugar Trust was ruled illegal in 1891, Henry Osborne Havemeyer and Theodore A. Havemeyer were elected chairman and president, respectively, of the American Sugar Refining Company, which in May 1896 became one of the original twelve companies listed in the Dow Jones Industrial Average. After absorbing the E.C. Knight Company and others, it controlled ninety-eight percent of sugar refining in America, surviving a Supreme Court antitrust challenge in 1895.

Immigration and Urbanization

Urban centers swelled with immigrants, especially from Southern and Eastern Europe, creating labor surpluses fueling industrial growth and significantly transforming regional culture. Nearly a quarter of the Canadian population emigrated southward to the U.S. between 1871 and 1896, reshaping the demographics further.

Public Health Challenges

Massive immigration and urban growth intensified public health crises. Infectious diseases caused severe fatalities, with an estimated twenty-five to thirty-three percent mortality among European immigrants to Canada before 1891. Cholera outbreaks, notably in Chicago in 1854, underscored ongoing urban health vulnerabilities.

Cultural and Social Shifts

The late nineteenth century saw heightened narcotic consumption, particularly opium. By 1896, American addiction peaked at over three hundred thousand individuals. Sensationalist media coverage by publishers like William Randolph Hearst fueled xenophobic fears, associating narcotic use with immigrants and criminals, prompting early narcotics regulation.

Intellectual and Cultural Trends

Robert G. Ingersoll, known as "the great agnostic," popularized scientific rationalism, humanism, and higher criticism of religious texts. His compelling lectures attracted national attention, influencing public discourse with intellectual vigor and challenging established orthodoxies.

Hudson River School artists, including John Frederick Kensett, George Inness, and Frederick Edwin Church, reached the zenith of their influence, romanticizing American landscapes and reinforcing the cultural identity rooted in the natural environment.

Fashion shifted toward more relaxed, country-inspired attire, with Norfolk jackets and knickerbockers—named after Washington Irving's fictional Dutch family—becoming popular among men.

Political Dynamics

Presidential elections reflected shifting political landscapes and changing cultural norms. Benjamin Harrison, notable for his full beard, defeated mustachioed incumbent Grover Cleveland in 1888. However, Cleveland reclaimed the presidency in 1892, overcoming Harrison and Populist candidate James A. Weaver. In 1896, clean-shaven Republican William McKinley defeated similarly beardless Democrat and Populist William Jennings Bryan, reflecting evolving political and social attitudes.

Legacy of the Era (1888–1899 CE)

This transformative period, marked by powerful industrial leaders, massive immigration, evolving cultural practices, and shifting political alliances, established a framework that profoundly shaped Northeastern North America's socioeconomic and cultural landscapes for decades to follow.

Tycoons like Cornelius Vanderbilt, John D. Rockefeller, and Andrew Carnegie lead the nation's progress in railroad, petroleum, and steel industries.

Banking becomes a major part of the economy, with J. P. Morgan playing a notable role.

Thomas Edison and Nikola Tesla undertake the widespread distribution of electricity to industry, homes, and for street lighting.

Thomas Edison has by 1890 formed the Edison Electric Light Company in New York City with several financiers, including J. P. Morgan and the members of the Vanderbilt family.

Chicago is selected on February 24, 1890, to host the World's Columbian Exposition, a world's fair to be held in 1893 to celebrate the four hundredth anniversary of Christopher Columbus's arrival in the New World in 1492.

Chicago has won the right to host the fair over several other cities, including New York City, Washington, D.C., and St. Louis.

The Exposition will be an influential social and cultural event and will have a profound effect on architecture, sanitation, the arts, Chicago's self-image, and American industrial optimism.

The fair is planned in the early 1890s during the Gilded Age of rapid industrial growth, immigration, and class tension.

World's fairs, such as London's 1851 Crystal Palace Exhibition, had been successful in Europe as a way to bring together societies fragmented along class lines.

The first American attempt at a world's fair in Philadelphia in 1876 had drawn crowds but was a financial failure.

Nonetheless, ideas about distinguishing the four hundredth anniversary of Columbus' landing had started in the late 1880s.

Civic leaders in St. Louis, New York City, Washington DC and Chicago had expressed an interest in hosting a fair to generate profits, boost real estate values, and promote their cities.

Congress had been called on to decide the location.

New York's financiers J. P. Morgan, Cornelius Vanderbilt, and William Waldorf Astor, among others, had pledged fifteen million dollars to finance the fair if Congress awarded it to New York, while Chicagoans Charles T. Yerkes, Marshall Field, Philip Armour, Gustavus Swift, and Cyrus McCormick had offered to finance a Chicago fair.

What finally persuades Congress is Chicago banker Lyman Gage, who had raised several million additional dollars in a twenty-four-hour period, over and above New York's final offer.

Chicago representatives had not only fought for the world's fair on monetary reasons, but also on practicality reasons.

On a Senate hearing held in January 1890, representative Thomas B. Bryan had argued that the most important qualities for a world's fair were 'abundant supplies of good air and pure water, ... ample space, accommodations and transportation for all exhibits and visitors ..."

He had argued that New York has too many obstructions, and Chicago would be able to use large amounts of land around the city where there is "not a house to buy and not a rock to blast.." and that it will be so located that "the artisan and the farmer and the shopkeeper and the man of humble means" would be able to easily access the fair.

Bryan had continued to say that the fair was of 'vital interest' to the West, and that the West wanted the location to be Chicago.

The city spokesmen would continue to stress the essentials of a successful Exposition and that only Chicago was fitted to fill these exposition requirements.

The Panic of 1893 sends the U.S. economy into an economic tailspin.

One of the causes for the Panic of 1893 can be traced back to Argentina.

Investment was encouraged by the Argentine agent bank, Baring Brothers.

However, the 1890 wheat crop failure and a coup in Buenos Aires ended further investments.

In addition, speculations also collapsed in South African and Australian properties.

Because European investors are concerned that these problems might spread, they start a run on gold in the U.S. Treasury.

Specie is considered more valuable than paper money; when people are uncertain about the future, they stockpile specie and reject paper.

During the Gilded Age of the 1870s and 1880s, the United States had experienced economic growth and expansion, but much of this expansion depended on high international commodity prices.

To exacerbate the problems with international investments, wheat prices crash in 1893.

One of the first clear signs of trouble comes on February 20, 1893, twelve days before the inauguration of U.S. President Grover Cleveland, with the appointment of receivers for the Philadelphia and Reading Railroad, which had greatly overextended itself.

Upon taking office, Cleveland deals directly with the Treasury crisis and persuades Congress to repeal the Sherman Silver Purchase Act, which he feels was mainly responsible for the economic crisis.

As concern for the state of the economy deepens, people rush to withdraw their money from banks, and cause bank runs.

The credit crunch ripples through the economy.

A financial panic in London combined with a drop in continental European trade causes foreign investors to sell American stocks to obtain American funds backed by gold.

J. P. Morgan becomes active in railroads following the crash, reorganizing several lines in the East.

The Northern Pacific Railway goes bankrupt in the great depression of 1893.

A complex financial battle ensues to take control of the railroad, because bankruptcy wipes out the bondholders and it is now free of debt.

A compromise is reached involving Morgan, New York financier E. H. Harriman and St. Paul railroad builder James J. Hill.

Who’s Who of 1895 credits J. P. Morgan with ownership of fifty thousand miles of United States railways.

Drexel, Morgan and Co. is reorganized by J. P. Morgan after Anthony J. Drexel's death in 1895 and becomes J.P. Morgan and Company.

It finances the formation of the United States Steel Corporation, which takes over the business of Andrew Carnegie and others and is the world's first billion-dollar corporation.

In 1895, it supplies the United States government with sixty-two million dollars in gold to float a bond issue and restore the treasury surplus of one hundred million.

Morgan markets U.S. government securities on a massive scale.